The Gaming Industry Evolution is reshaping how players, developers, investors, and journalists think about games today. From devices and distribution to funding and design, rapid change touches every corner of the ecosystem. In this post, we explore the forces driving the shift, translate jargon into plain language, and outline what it means for creators and players. Key themes include gaming trends 2025, cloud gaming impact, live-service models, cross-platform play, and the balancing act between premium franchises and indie innovation. By linking these trends to real-world aspects like accessibility, monetization, and community building, we set the stage for informed decisions.

Viewed through a different lens, this shift resembles a broader industry transformation in digital entertainment, where technology, distribution, and audience behavior intersect. Think of it as the evolution of the gaming ecosystem: cloud-enabled access, recurring revenue through live services, and cross-device progress. Another way to frame it is as a marketplace redefinition—subscription catalogs, creator-driven content, and broadening participation shaping what people play and how they pay. From a user experience perspective, it’s about immersive experiences, social play, and interoperability across consoles, PCs, and mobile devices. In short, the ongoing evolution reflects broader shifts in interactive entertainment, where technology, business models, and cultural trends together steer the next chapter.

Gaming Industry Evolution: Forces Shaping the Next Era

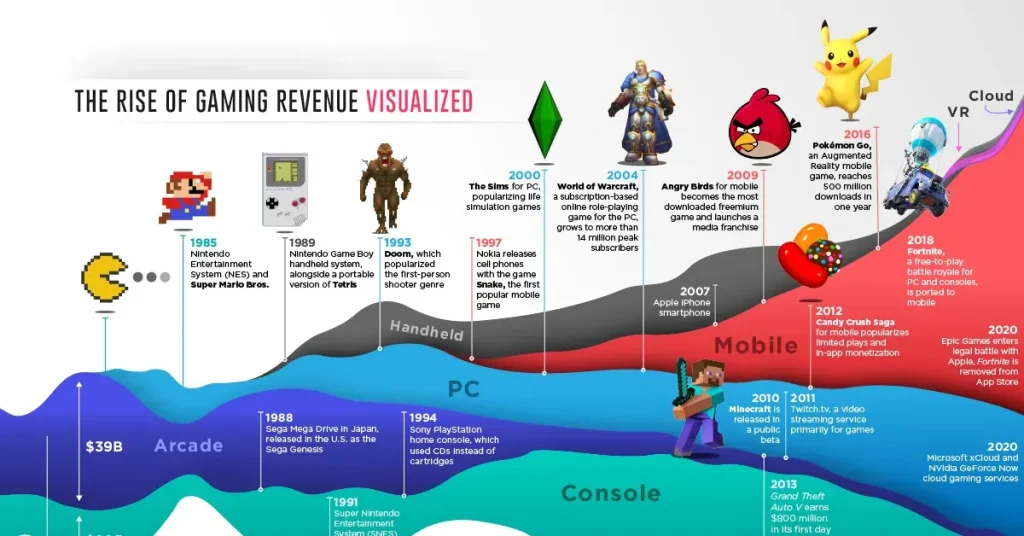

The Gaming Industry Evolution isn’t a single trend but a tapestry of interlocking shifts that redefine how games are created, distributed, and experienced. Technology upgrade cycles, business model experimentation, and a broader cultural move toward immersive, social play all contribute to a dynamic landscape. In discussions of gaming trends 2025, cloud-enabled access, live-service models, and cross‑platform play repeatedly surface as core drivers that reshape expectations for players and developers alike.

As stakeholders—from players to investors—grapple with this evolution, the focus turns to sustainable growth and transparent practice. The concept of Gaming Industry Evolution emphasizes a holistic view: faster networks, smarter AI in development, and more adaptive monetization strategies factor into ongoing decision making. Market signals like video game market growth across platforms and regional shifts illustrate how the ecosystem expands as new tools empower smaller studios and veteran teams to reach broader audiences.

Cloud Gaming Impact on Accessibility and Hardware Demands

Cloud gaming impact is most visible in how it lowers hardware barriers and broadens who can join the action. Gamers can log in on a modest laptop, a mid‑range phone, or a smart TV and still enjoy rich visuals and responsive play without a top‑tier rig. This shift complements traditional hardware, expanding entry points for players who might not own the latest consoles or high‑end PCs, while streaming libraries and subscriptions reshape how people access content.

Yet cloud gaming isn’t a cure‑all; it carries tradeoffs in latency, bandwidth, and sustainability. Services compete on compression, edge infrastructure, and adaptive streaming to preserve quality during peak moments. As cloud capabilities mature, expectations rise for smoother experiences and broader device compatibility, a trend that reinforces the gaming trends 2025 narrative of more inclusive and flexible pathways to play.

Video Game Market Growth Across Platforms

Video game market growth continues to unfold across console, PC, and mobile ecosystems, with cloud services weaving these platforms into a more cohesive experience. Growth isn’t tied to a single channel; it’s the result of multi‑platform strategies, cross‑promotion, and an expanding library of live, service‑driven titles. Stakeholders watch how investments in each ecosystem contribute to overall momentum and revenue in the global market.

The balance among platforms shifts with consumer behavior and accessibility. As mobile gaming growth accelerates, developers scale experiences for touchscreens and shorter play sessions without sacrificing depth. This dynamic supports a nuanced picture of console vs PC gaming trends, where blockbuster exclusives can drive hardware cycles, while PC ecosystems highlight performance tuning and competitive communities, all contributing to the broader canvas of video game market growth.

Mobile Gaming Growth: The Global Engine of Engagement

Mobile gaming growth is a powerful engine for engagement on a global scale, reaching audiences in regions where traditional consoles are less prevalent. Smartphone‑first experiences, shorter play windows, and microtransaction models fuel rapid adoption and frequent return visits. This ubiquity reinforces the importance of optimizing for low latency, energy efficiency, and intuitive touch interfaces as central pillars of the mobile strategy.

For developers, mobile growth invites innovations in onboarding, accessibility, and monetization, while still aligning with broader gaming trends 2025. Cross‑device play, lightweight but meaningful progression, and cloud‑backed libraries help bridge mobile to other platforms, expanding the total addressable market. The shift also pressures studios to balance performance, battery life, and user experience to sustain long‑term engagement.

Console vs PC Gaming Trends: Navigating the Cross-Platform Era

Console vs PC gaming trends reveal a hybrid reality where exclusives still command attention, but cross‑platform ecosystems grow in importance. High‑fidelity experiences on consoles coexist with PC communities centered on modding, customization, and competitive play. The evolving landscape emphasizes the need for scalable tools, better account ownership, and seamless cross‑play that keeps players connected across devices.

Cross‑platform expectations increasingly shape monetization, content cadence, and community management. As players demand persistent progress across devices, developers must align on data privacy, updates, and social features that prevent fatigue. This cross‑platform momentum feeds into the broader objective of Gaming Industry Evolution, reinforcing how console, PC, and mobile ecosystems can mutually reinforce growth and player retention.

Live Services, AI Tools, and the Persistent World

Live services, supported by AI‑assisted design and procedural generation, are redefining how games stay relevant after launch. Seasonal content, dynamic events, and evolving economies provide predictable revenue streams while challenging studios to maintain balance, player interest, and meaningful progression. The ongoing refinement of these systems mirrors the gaming trends 2025 playbook, where long‑term engagement depends on cadence, quality of content, and social hooks.

Advances in AI and toolchains empower smaller teams to punch above their weight and experiment with expansive, persistent worlds. This democratization of development aligns with broader video game market growth, as more titles launch and players find deeper, more personalized experiences. Ethical monetization, data privacy, and transparent communication remain critical as immersive experiences intensify and communities grow.

Frequently Asked Questions

In the Gaming Industry Evolution, what are the key drivers behind gaming trends 2025?

The Gaming Industry Evolution in 2025 is driven by cloud gaming, live-service models, cross-platform play, and a focus on accessibility and immersion. These forces reshape funding, distribution, and player expectations, as more players access titles across devices with richer online experiences.

How does cloud gaming impact the Gaming Industry Evolution and influence video game market growth?

Cloud gaming reduces hardware barriers, expands audience reach, and enables instant access to libraries. This cloud gaming impact fuels video game market growth by attracting new players, enabling flexible pricing, and integrating with streaming platforms.

What do console vs PC gaming trends reveal about the Gaming Industry Evolution?

They reveal a hybrid era where consoles attract blockbuster experiences and PC remains premier for performance and modding; cross-platform play is becoming standard, tying ecosystems together and supporting sustained communities.

Why is mobile gaming growth central to the Gaming Industry Evolution?

Mobile gaming growth broadens the audience, drives UI/UX innovation, and pushes monetization and localization strategies, influencing the overall trajectory of the Gaming Industry Evolution.

How do live service models fit into the Gaming Industry Evolution and affect video game market growth?

Live service delivers predictable revenue through seasonal content and battle passes, but requires balanced content cadence and ongoing social hooks to keep players engaged, shaping the market’s growth and expectations.

What should developers consider about cross-platform play and account ownership in the Gaming Industry Evolution?

Cross-platform play and account ownership are now baseline expectations; developers should ensure secure cross-progression, consistent experiences, data privacy, and clear communication to sustain communities across devices.

| Theme | Key Points | Impacts / Examples | Stakeholders |

|---|---|---|---|

| Technology & Distribution | Cloud gaming is now viable and often complements, not replaces, local hardware; streaming platforms and subscriptions shape expectations with large libraries and always-on access. | Lower hardware barriers; new entry points; broader audience; smoother onboarding across devices; value of services grows. | Players, developers, cloud/streaming providers, hardware manufacturers |

| Market Growth Across Platforms | Console, PC, and mobile ecosystems contribute; cloud services weave ecosystems; cross-platform play and cross-progression persist; mobile drives UI innovations. | Hybrid realities; high-end exclusives still attract console audiences; PC remains hub for mods and performance; mobile optimization drives UI and energy efficiency. | Players, publishers, platform holders, developers |

| Development Tools & Methods | AI-assisted design, procedural generation, and advanced physics engines; live-service models extend lifecycles. | Smaller studios can compete; longer title lifecycles; ongoing content cadence and social hooks to retain players. | Developers, publishers, tool vendors |

| Business Models & Monetization | Revenue mix includes upfront purchases, subscriptions, microtransactions, and user-generated content; emphasis on ethical monetization and transparent data practices. | Diversified revenue; consumer trust; sustainable growth; regulatory considerations. | Players, developers, regulators, advertisers |

| Global Accessibility & Localization | Regional dynamics shape pricing and content; localization and culturally relevant content expand adoption; accessibility improvements widen audiences. | Global reach; region-specific strategies; varied revenue patterns. | Regions, studios, localization teams, investors |

| Future Outlook (2025+) | Focus on accessibility, immersion, and community; improvements in cloud compression, networks, and on-device chips; VR/AR growth; metaverse elements in some titles; cross-platform experiences. | New devices; longer path to mass VR/AR adoption; persistent social spaces; broader cross-platform reach. | Players, hardware makers, developers, network providers |